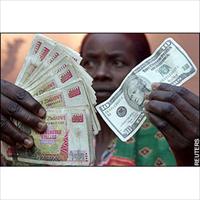

ZIMBABWE: Money for nothing

Attempts to alleviate Zimbabwe's critical cash shortages through the introduction of higher denomination notes are so far proving ineffective, as long bank queues have remained into January 2008.

Late last year, Reserve Bank of Zimbabwe Governor, Gideon Gono, introduced three high denomination bearer cheques, Z$250,000 (about US$0.12 at the parallel market rate of US$1 dollar to Z$2 million), Z$500,000 (US$0.25) and Z$750,000 (US$0.37), after initially announcing the phasing out of the Z$200,000 (US$0.10) bearer cheques, which he said were now in the hands of "cash barons" who were selling the notes as a commodity.

"Of the Z$67 trillion (US$33,5 million) which has been printed, we can only account for Z$2 trillion (US$1 million) which is in the formal banking system. The rest of the money is with cash barons who have opened mini-central banks at their houses. Unfortunately the people doing that are influential citizens with leadership positions," Gono told IRIN recently.

Zimbabwe, which is battling the world's highest inflation rate officially pegged at 8,000 percent - but unofficially estimated by independent economists at 25,000 percent - has seen cash join a catalogue of other shortages, which include fuel, electricity and food.

Gono said that high ranking people within Zimbabwe's corridors of power hoarding cash were known to him. Some such as an advisor to the Reserve Bank, Jonathan Kadzura, found to have taken $10 billion (US$5,000) of the freshly minted $500,000 (US$0.25) notes out of the banking system have been exposed. While David Butau, chairperson of the Finance Parliamentary Portfolio Committee and a Member of Parliament in the ruling ZANU-PF fled to United Kingdom last week amid reports of irregular financial dealings.

Individuals are only permitted to withdraw a maximum of Z$50 million (US$25) daily, while companies can make daily withdrawals of $100 million (US$50).

The Reserve Bank's decision to withdraw the $200,000 (US$0.10) bearer cheques as legal tender on 31 December 2007, was rescinded without explanation, although vendors had stopped accepting the $200,000 (US$0.10) bearer cheques well ahead of the new year's eve deadline.

Simple economics

Sipho Manyumbu, a school teacher in the capital Harare who spent the holiday season in bank queues, said it was nonsensical for Gono to claim that the cause of the money shortage was a consequence of the rise of the cash baron.

"Simple mathematics will prove to the Reserve Bank governor that the Z$67 trillion (US$33,5 million) he is mourning about if divided by 14 million Zimbabweans (the country's estimated population) will leave each person with about Z$6 million (US$3), which is not enough to buy a kilogramme of meat.

"With our inflation now way above 20,000 percent, it no longer makes sense to keep money in the bank because getting it out is cumbersome. I now withdraw all my salary and keep the money at home but so far I have not been able to get any money."

Tendai Musemburi, a former banker, told IRIN that while there were people hoarding cash to exchange for foreign currency, its effect was negligible.

"The issue is that the money is with the people. There is a lot of money chasing very few goods because of the decline in the manufacturing sector ... But they can not use it because there is either nothing to buy or the goods have just become too expensive," he said.

Back and Next - Back and Next

Back and Next - Back and Next See Also - See Also

See Also - See Also